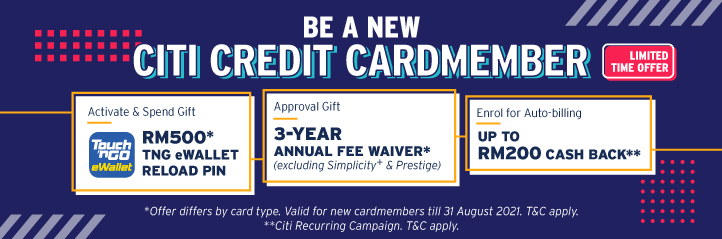

RM500 Worth of TNG eWallet Can Be Yours Just By Signing Up As New Citi Credit Cardmembers

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

This Spotlight is sponsored by Citibank.

Thinking of getting a credit card? Now is a great time to apply for one, ’cause Citibank is rewarding you with a RM500 Touch ‘n Go eWallet reload pin!

From now until 31 August, Citibank is giving away a welcome offer consisting of Touch ‘n Go eWallet reload PIN worth RM500, as a way to welcome their new credit cardmembers! And it’s so easy to claim – just apply for a Citi credit card and spend at least eight times with it to claim your reload pin.

Best of all, Citibank offers a plethora of credit cards, each designed to cater to your specific needs. Whether you prefer a credit card that lets you earn cash back or miles, or one that rewards you with Citi Rewards points, Citibank has got it all.

And exclusively for Citi credit cardmembers, you can participate in their ‘In It 2 Win It‘ campaign to stand a chance to win cool prizes including Samsung Galaxy S21 Ultra 5G, Apple iPad Pro, and more!

Not sure which one to apply for? Here are our picks of Citi credit cards that reward you with cash back or Citi Rewards points, especially if you prefer to shop for things at home. Stay safe, spend smart!

Whether you do your groceries, stock up on beauty products, shop for gadgets, or order food, Citibank knows just how important it is to get things done online.

Now, you can get the most out of your spending by enjoying rewards from not only online platforms, but from your credit card as well.

Check out these Citi credit cards that are great for shopping from the comfort of your own home:

1. Citi Cash Back Card

Nothing is more convenient than ordering food and having it delivered to you, right? The Citi Cash Back Card rewards you with 10% cash back on food delivery via foodpanda and DeliverEat when you meet the minimum monthly spend. Remember to use your Citi Cash Back Card to enjoy this perk if you already have this card! The offer lasts until 31 August.

That’s not the only perk! You can also enjoy 10% cash back if you spend on groceries, dining, petrol, or Grab. From buying daily essentials via GrabMart, to shopping online via GrabPay, you’ll still be rewarded with cash back. You can earn up to RM40 if you spend with the Citi Cash Back Card, while spending with the Citi Cash Back Platinum Card gives you up to RM60 cash back. All you need to do is meet your monthly spending requirement.

Best of all, your cash back will automatically be credited to your account.

Check out the full perks:

– Up to 10% cash back on Grab, groceries, dining, and petrol when you meet the minimum monthly total spend

– Unlimited 0.2% cash back on other retail spend

– Automatic cash back credited into your account

– 10% cash back on food delivery when you meet the minimum monthly total spend (valid until 31 August)

Terms and conditions apply. Apply for a Citi Cash Back Card today.

2. Citi Rewards Card

Love accumulating reward points? Citibank’s Citi Rewards Card lets you collect heaps of points whenever you shop or spend via e-wallet.

Even shopping for groceries have never been more rewarding. You can earn 5x Citi Rewards points when you shop for daily necessities at Cold Storage, Village Grocer, and many more.

Additionally, if e-wallets are your go-to payment, Citibank rewards you with 12x Citi Rewards points whenever you top up your e-wallet using the Citi Rewards Card. Niceee!

What’s also great about the Citi Rewards Card is that your Citi Rewards points will never expire. You can accumulate Citi Rewards points to offset your purchases!

Check out the full perks:

– 5x Citi Rewards points at Taobao, Lazada, and Amazon (valid until 15 September)

– 12x Citi Rewards points for e-wallet top ups including Touch ‘n Go eWallet, Boost, and BigPay

– 12x Citi Rewards points at iTunes

– 5x Citi Rewards points at major department stores and supermarkets such as Cold Storage, Jaya Grocer, Village Grocer, and many more

Terms and conditions apply. Apply for a Citi Rewards Card today.

3. Lazada Citi Credit Card

Lazada shoppers, rejoice! If you love shopping on Lazada, this Lazada Citi Credit Card is the ultimate credit card for you, as you not only accumulate LazCoins on the shopping site, but also collect 10x Citi Reward points.

Besides shopping on Lazada, the card also has lots of perks when you spend on GrabFood, DeliverEat, foodpanda, Netflix, Spotify, and more.

And thanks to the Lazada Citi Credit Card’s exclusive perks, you can also offset your purchases using your Citi Rewards points. You can even earn reward points if you top up your Lazada Wallet using your credit card.

Check out the full perks:

– 10x Rewards points on Lazada spends and Lazada Wallet

– Exclusive Lazada privileges and benefits

– 5x reward points on online and lifestyle category spends

– 1x and monthly bonus reward points on petrol and all other spends

Terms and conditions apply. Apply for a Lazada Citi Credit Card today.

From now until 31 August, remember to grab your Touch ‘n Go eWallet reload pin when you apply for any of the Citi credit cards!

Besides earning a reload pin, Citibank also offers a three-year annual fee waiver and up to RM200 cash back when you enrol for any auto-billing including Netflix, Tenaga Nasional Berhad, telco bills, and more.

To enjoy their limited time offer, all you need to do is apply for a Citi credit card and spend eight times for any retail transactions. With Citibank’s new Temporary Card Verification Value (CVV) feature, you can now activate your credit card via Citi Mobile App even before your credit card arrives at your doorstep.

This means you can start enjoying your card benefits. Whether you shop online or top up your eWallet, enjoy earning cash back, reward points, or miles right away.

Terms and conditions apply.

Other than that, if you’re looking to apply for a personal loan, Citibank currently offers personal loans with low flat interest rates from only 5.33% per annum.

Additionally, you can obtain Citi Personal Loans with zero processing fees, up to 10x your gross salary, and have the option to select a tenor of 24 to 60 months to pay for the loan. With Citi Personal Loans, you can now manage your finances with added assistance.

As we’re all encouraged to stay at home, Citibank has a seamless journey for you to apply for Citi Personal Loans online. All you need to do is fill up the online form, upload your NRIC image, and upload necessary documents such as salary slips, etc. Find out more here.

Terms and conditions apply.

Get the most out of your spending with Citibank today! Head over to their website for more info.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM