Zurich And GXBank Unveil Cyber Fraud Insurance Shielding Malaysians from Digital Scams

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

In a move aimed at bolstering digital security for Malaysians, Zurich General Insurance Malaysia Berhad and GXBank Berhad have unveiled a new insurance product designed to guard against financial losses from unauthorised electronic transactions.

Launched on 28 August 2024, the Cyber Fraud Protect insurance is integrated into the GXBank mobile app, leveraging Zurich’s advanced Edge platform.

This new digital insurance offering addresses the growing issue of cybercrime, which has significantly impacted Malaysians. Recent data from the Federal Commercial Crime Investigation Department reveals a staggering RM1.6 billion in losses from online scams over a 19-month period leading up to July 2024.

As digital transactions become increasingly common, so too does the risk of falling victim to cyber fraud. Cyber Fraud Protect aims to counteract these threats by providing coverage for unauthorised transfers from various financial accounts, including local bank accounts, e-wallets, and credit or debit cards.

Junior Cho, Country CEO/Head of Zurich Malaysia, emphasised the product’s alignment with Zurich’s commitment to customer care. “Our collaboration with GXBank has led to the development of Cyber Fraud Protect, a solution that ensures security in an increasingly digital world. We’ve prioritised a seamless customer experience, and the Zurich Edge platform allows us to offer an effortless in-app purchasing journey for GXBank users,” Cho said.

Pei-Si Lai, Chief Executive Officer of GXBank, also highlighted the product’s uniqueness and broad coverage. “Cyber Fraud Protect is one-of-a-kind in the market, offering up to RM20,000 in protection against losses from cybercrimes. It extends coverage across all local bank accounts, debit and credit cards, and e-wallets, far beyond just GXBank’s ecosystem. This launch is part of our broader mission to enhance financial resilience among Malaysians,” Lai explained.

To mark the launch, a panel discussion was held to address the pressing concerns surrounding cyber fraud in Malaysia. The panel, moderated by TV host and producer Nazrudin Rahman, included experts such as ASP Rahmat Fitri Abdullah, Founder/Director of Rahmat Fitri Consultant Sdn Bhd; Ooi Jian Wei, Associate Dean at Tunku Abdul Rahman University of Management and Technology; Vincent Mok, Chief Risk Officer of GXBank; and Evelyn Ng, Deputy Chief Claims Officer (Property & Casualty) at Zurich Malaysia.

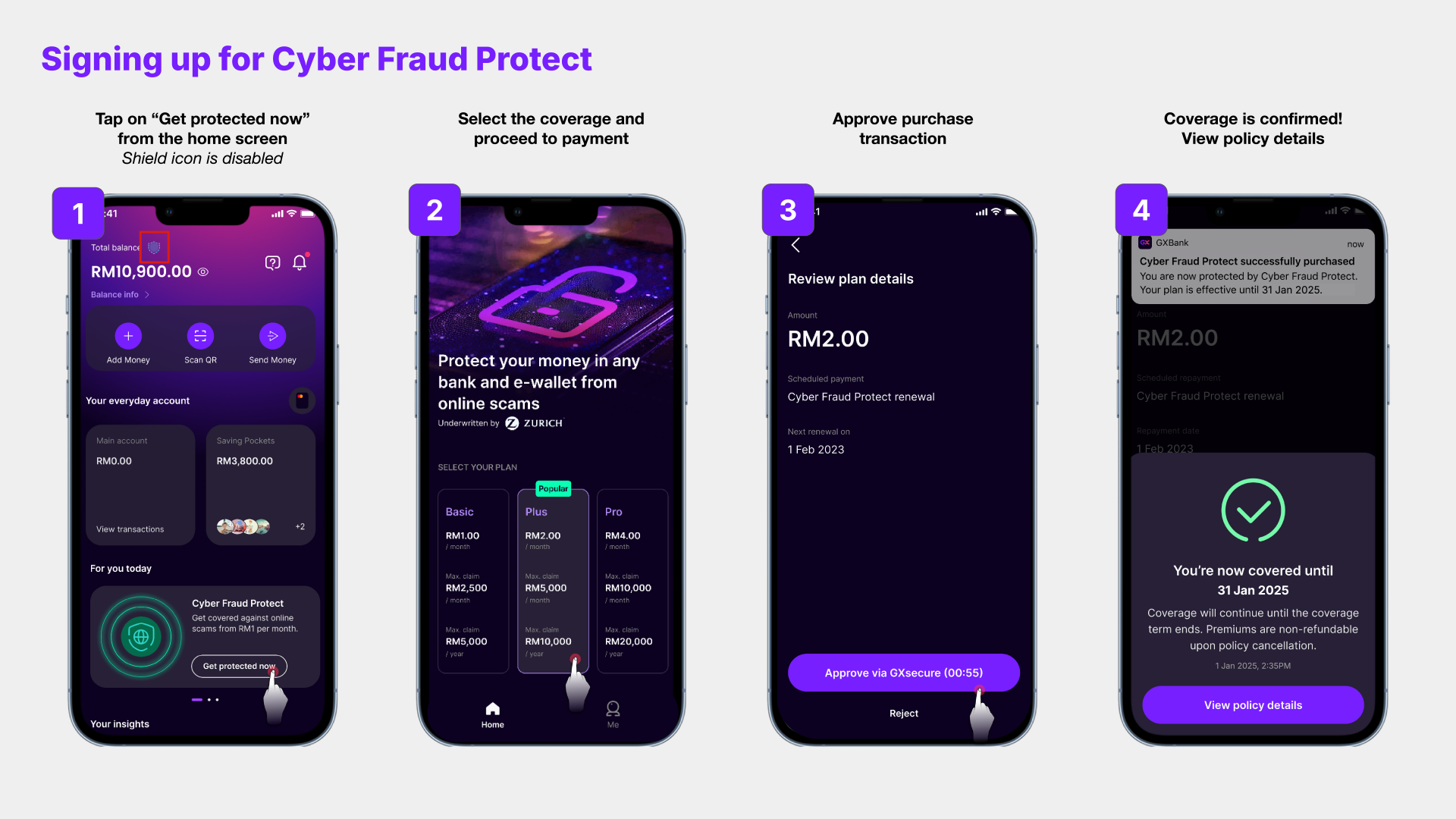

For those interested in securing Cyber Fraud Protect, the process is pretty straightforward:

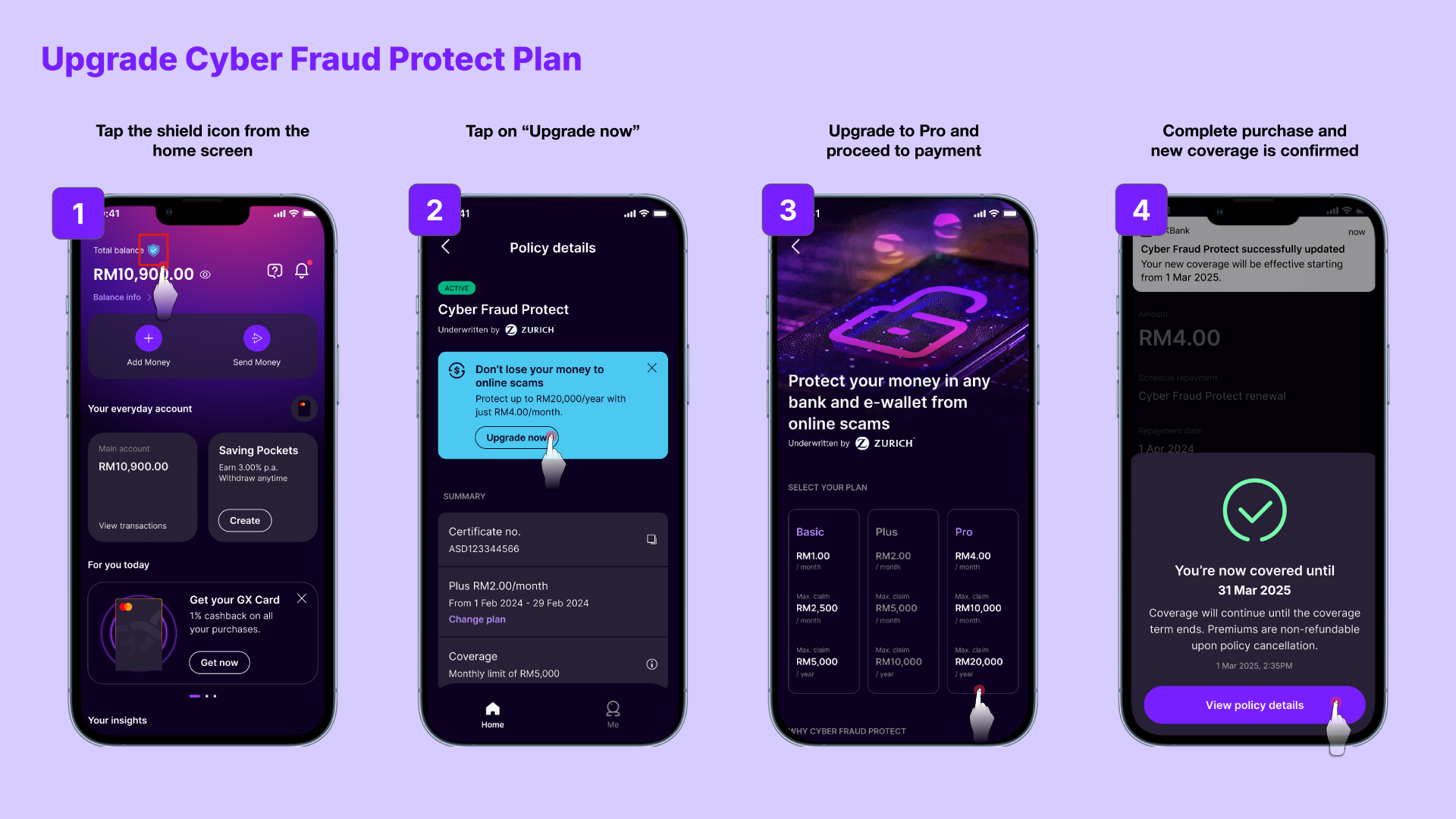

Users can select from three coverage plans – Basic (RM1/month), Plus (RM2/month), or Pro (RM4/month) – directly within the GXBank app.

After choosing a plan, users need to verify their email, confirm their selection, and approve the transaction through GXSecure. The policy activates immediately, with coverage details available in-app and a certificate of insurance sent via email. The monthly premium is automatically deducted from the user’s GXBank account.

For more information about Cyber Fraud Protect, visit the official website here.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM