“I Left My 5-Figure Salary” – Successful M’sians Share How They Became Insurance Agents

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

When it comes to becoming an insurance agent, many Malaysians don’t usually see it as their first career option

For fresh grads, it may not seem like a job that they studied for. Those with a stable job might also feel like going into insurance is a financial risk. Besides that, being an insurance agent still comes with the social stigma that people will stay away from you.

However, being an insurance agent does come with its benefits. Not only are the hours flexible, insurance is something that will always be in demand, making it a pandemic proof kind of job. Besides that, joining insurance gives you the opportunity to fast track your career while helping others.

Read on to find out more about becoming an insurance agent with Prudential or visit their website.

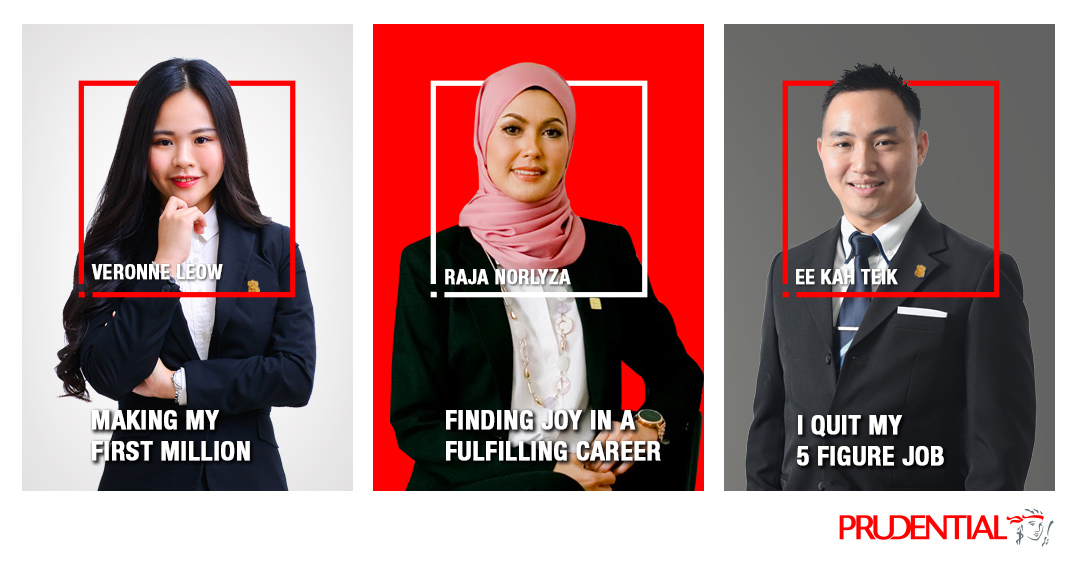

In collaboration with Prudential, we spoke to three successful Malaysians from different backgrounds who became insurance agents:

1. As a fresh grad coming back from the UK, Veronne Leow decided to pave her own career path instead of taking the conventional way

Hailing from Penang, 26-year-old Veronne Leow has been a Prudential agent for four years. When she first graduated, she wanted to join a big multinational corporation (MNC) to gain experience. But after talking to friends and seniors, she realised it would be a struggle and take a long time to climb the corporate ladder.

“I thought to myself, ‘How long will it take me to earn my first million if I’m employed?’ I wanted a fast track, and that’s why I chose insurance.”

Coming back as a fresh graduate from overseas, she had lost contact with most of her friends, and had to basically start from ground zero. Nevertheless, she never stopped reaching out to people and provided good service to build her customer base.

Within a short span of four years, Veronne overcame the odds and made her first million ringgit. She also qualified for Million Dollar Round Table (MDRT)*, a prestigious mark of excellence for those in insurance.

“During this pandemic, I feel lucky to be in this industry. While I’ve heard of friends getting pay cuts and retrenchment, Prudential has provided us with a digital platform to help us continue doing our sales remotely. Compared to my peers, I think I’m doing quite well. Some of them still don’t know what they want to do with their career. “

At just 26 years old, Veronne is already far ahead of the curve. She’s enjoying her career in insurance, while earning a fulfilling income.

“It’s a joy to fight for your goals and still have the chance to spend quality time with your family, friends, and colleagues. But the most fulfilling thing about being an insurance agent is the opportunity to help others.”

“One of my college mates bought medical insurance with me in October 2017. Within the next few months, she had to go in the hospital three times because of appendicitis, uterus cyst, and kidney stones. I’m happy that most of my customers are healthy, but in cases like this, she was so lucky that she got her insurance in time and was able to claim. And I’m glad I was able to be there for her through it all.”

2. After being a banker and running her own businesses, Raja Norlyza started again from scratch, despite not having her family’s support

A serial entrepreneur at heart, Raja had 16 years of experience as a banker before opening her own laundry business and becoming a wedding planner. In 2009, she joined as a Prudential agent, but was met with disapproval from her family members.

“My biggest struggle was not having the support of my family. Nevertheless, I gave myself a time frame of 12 months to prove to them that I made the right decision.”

Within a year, Raja made great progress. Seeing how her income grew, her family began to gain confidence in her and supported her all the way. Now, 11 years later, Raja shares how she got to where she is today.

“What really helped me grow as a Takaful consultant was the MDRT mentor and mentee programme. Being able to learn from someone who was ahead of me in their journey made me realise I’m not in this alone. The training and branding guidance from PRUEntrepreneur also allowed me to progress to where I am today.”

Besides earning a side income, Raja shared that the main reason why she went into Takaful was to help more people

“My most memorable experience was helping my customer’s family when he passed away. As the breadwinner of the family, he left behind his wife and four children. While his coverage with Prudential wasn’t much, he bought a few other insurance through telemarketing, and I went the extra mile to help the family settle all these claims.”

“It wasn’t an easy time. I regretted not giving my customer a higher coverage, but the wife was so appreciative of me. I really felt that my job as an insurance agent was made more meaningful because of this.”

According to Raja, anyone can become an insurance agent, whether you’re self-employed, a fresh graduate, or an employee. While the income is a great benefit, she says that nothing feels better than having the opportunity to help others when they need it the most.

3. Professional engineer Ee Kah Teik left his five-figure salary to pursue a whole new career as an insurance agent

As an engineer, Kah Teik was already at the peak of his career by age 30, earning more than RM120k each year and reporting directly to the managing director. However, that’s when he decided to leave his job and become an insurance agent with Prudential.

“Although I was grateful for the pay and benefits at my job, I realised I was at a bottleneck in my career, with no path to grow. At the same time, my working hours were long and I had to travel a lot, often neglecting my children and family.”

Upon joining Prudential, Kah Teik managed to qualify for Star Club within a year and the prestigious MDRT within three and a half years of going full-time.

“I often get asked why I resigned and went into insurance. My response is always, ‘Why not? Insurance is an exciting industry!'”

“As an insurance agent, I have a big task of helping people plan their wealth, which means I need to consistently equip myself with up-to-date knowledge. Just like how doctors give medical advice, we provide financial advice based on customers’ dreams and goals. Every person has different goals, which makes our job challenging and exciting.”

“Thankfully, PRUEntrepreneur has provided me with continuous learning, as well as opportunities to excel. The MDRT mentor and Mentee programme allowed me to learn from great leaders who are consistent MDRT qualifiers, while giving me a chance to mentor others as well.”

For Kah Teik, his happiest moments are when he gains the trust of his customers and is able to help them in their time of need

“For me, when someone I’m meeting for the first time signs a lifelong policy with me, the feeling is fantastic! It shows how much they believe in the agent and company to protect their best interests. I also love it when I’m able to deliver claims to clients upon successful processing. Just a word of thanks from them can light up my day.”

Whether you’re job hunting, looking for greener pastures, or want to earn a side income, being a Prudential insurance agent could be the right step for you

As shown by the stories of Veronne, Raja, and Kah Teik, you can find success in insurance no matter what background you come from. Here are a few benefits of becoming an insurance agent:

It’s a pandemic proof kind of job

Even during COVID-19, many customers evaluated and increased their insurance coverage with Prudential. This shows how important insurance is to Malaysians.

It’s flexible

You can choose to work from home, meet customers via video call, or meet up with them in person – the choice is yours. The hours are also flexible, which means you can arrange your own schedule to meet your financial goals.

It’s fulfilling and purposeful

As an insurance agent, you’re not just selling a product. You get the opportunity to give your customers peace of mind with protection, while helping them achieve their life goals and milestones.

Prudential Malaysia CEO Gan Leong Hin shares how Prudential is able to help you achieve your future goals:

“At Prudential, we offer more than just a platform and the chance for you to become your own boss. Joining a new industry can be challenging, but at the same time, it also means new learning opportunities!

That’s why our comprehensive training and development programmes such as Entrepreneur Development Programme and PRUVenture are designed to help you start right in this industry, no matter your background or experience.

We are here not just to help you change your future, but to take charge of it. Plus, we also want you to achieve your best – to maximise your potential and accomplish your aspirations. So, what are you waiting for?”

If you’re just starting out or worried about transitioning, Prudential offers elite fast track programmes to help you jumpstart your career. Find out more here.

– Enjoy training and mentorship support from a dedicated team of industry professionals

– Make the most of an income booster plan to support your career transition

– Be part of a tried and proven success model formula proprietary to Prudential, allowing you to reach the MDRT standard for a promising career path

*Million Dollar Round Table (MDRT) is recognised internationally as the standard of excellence in the life insurance and financial services business. To be part of MDRT, insurance agents have to achieve a minimum amount of commission, income, or premium, while adhering to strict ethical standards. Find out more about MDRT.

Wondering how suitable you are to become an insurance agent? Take this personality test on Prudential’s website to find out more!

This story was originally published on SAYS.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM