Scammers Are Hunting Young Investors, Here’s How to Spot a Scam Before It’s Too Late

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

If you think that only senior citizens get scammed, you’re wrong. Although older victims dominate the headlines – which is truly sad as some have lost their life savings – there is a steady increase in scams targeting the youth.

Criminal analyst Kamal Affandi Hashim, in an article by NST, quoted statistics from the Women, Family, and Community Development Ministry, where 26.2% of online scam victims were aged between 20 and 30 from the year 2019 to 2021.

“The elderly may fall for scams that exploit their compassionate nature. On the other hand, younger people succumb to lifestyle temptations,” he said. In other words, FOMO culture is hurting young adults who have just started working and saving, especially when social media is rife with influencers flaunting their wealth.

As more people fall victim to scams, society develops a distrust for investing and young people end up investing only at later stages in life (or not at all). This leads to an ageing population that has to rely on younger generations to financially support them.

While scammers have gotten more sophisticated, there are tell-tale signs of their traps. Here are 8 things to keep in mind to protected yourself against scams…

1. Always check with Bank Negara and the Securities Commission

You would not trust a restaurant without a health certification, likewise, you should not trust an investment scheme that is not regulated by the Securities Commission (SC) and Bank Negara.

Most credible investment schemes require authorisation or registration with governing regulators. When in doubt, contact the SC at [email protected] or call +603 6204 8999 (9 a.m.-6 p.m., Mon-Fri).

Both the SC and Bank Negara websites frequently update their Alert Lists which warn investors about the latest scams.

2. Be aware of impersonators

The scariest thing about scammers these days is that they are able to impersonate government officials, private companies, and even celebrities – from LHDN or Bank Negara staff to CEOs and sports figures, you name it. There was even a scam exploiting PMX’s image and speech using deepfake AI tech.

Hackers can also gain access or create dummy accounts similar to your inner circle.

Above all, they can impersonate legitimate financial influencers whom you might trust.

3. Only download official apps from the Apple App Store or Google Play

If the investment app is not an official app from the App Store or Google Play, then it is scam. Do not download the app, instead report the scam to the authorities.

Do not download P2P apps or open files sent to you on messaging apps. There are no legitimate apps distributed this way.

4. If it’s too good to be true, it’s a lie

It’s easy to get caught up in FOMO culture where influencers flaunt wealth on social media. But success has no shortcuts. Any person or company promising high and fast returns with low risk is likely a scammer.

High returns usually involve greater risks, and it is unwise to dive into trading risky assets if you have not, at the very least, done extensive research.

5. Don’t be pressured to act fast, don’t trust a new acquaintance

There is no need to rush into an investment. Scammers like to use urgency to pressure investors. They will say things like “if you don’t act now you’ll be missing out” or try to play on your weakness of not being “man enough” to make a decision.

You should also be aware of other types of scams as well because the scammer might be using a hybrid of methods to trick you – for instance, ‘pig butchering’ is when a scammer combines a love scam with an investment scam.

6. Don’t transfer funds to a personal account

You should not transfer your funds to any account that is not the official account of a regulated company.

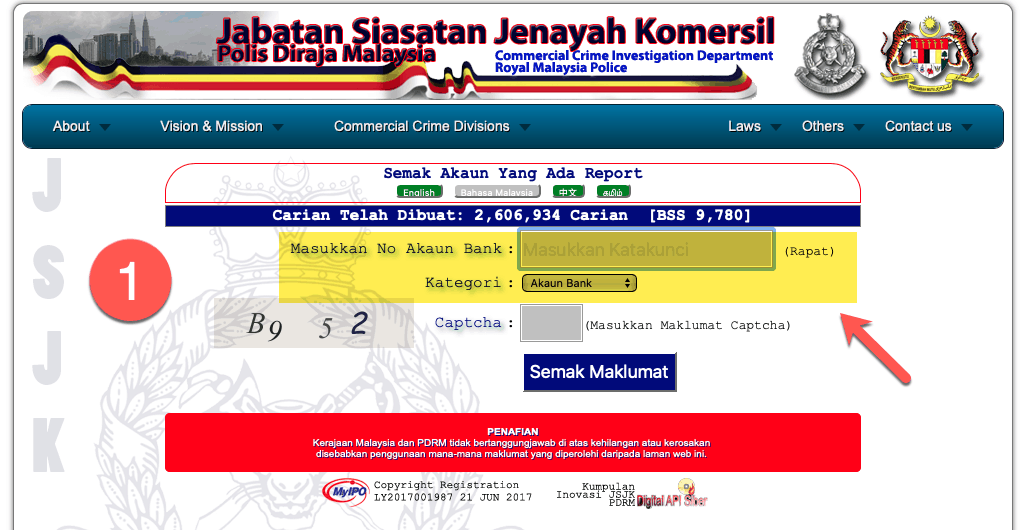

Use Semak Mule (a website and app set up by the Commercial Crime Investigation Department) to check if the bank account is linked to scammers.

If you have already verified and downloaded an official app, transfers to your trading account or wallet would likely be done in the app itself.

7. Avoid WhatsApp and Telegram groups like it’s the plague

Messaging apps are where scammers play out their traps.

Do not join WhatsApp and Telegram groups that offer investment opportunities. The other participants in the group are bots and reading from a script to make it sound legit.

8. Beware of advertisements online

Before scam advertisements are reported, they can reach your feed and trick you into clicking on them. You could be brought to a fake website impersonating a legitimate one as well.

If you see an attractive offer you like in an ad, verify the source and company before clicking on it.

And if you’re still not sure… just walk into a bank

Just walk into a bank and tell them you want to explore investing opportunities. All major banks have their own investment apps and products which enable you go buy into markets locally and abroad. While you may not get the best deal in terms of fees and variety of assets to invest in, banks are a good starting point for newbies and often partner with reputable hedge funds.

Keep in mind, most scam victims were lured into traps because they did not verify the sources. If you initiate your own investment journey and take your time to look at all the products that are available in the market – from fintech apps to hedge funds and so on – you will most likely be able to tell if what’s in front of you is real or a scam.

For the latest news, stay fresh with JUICE.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM