FinTech & Beyond: JUICE’s Guide To Saving Money In 2024

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

As we usher in a new year, the age-old resolution of saving money and achieving financial fitness takes centre stage. In the digital era, the plethora of options for managing finances can be overwhelming and even risky.

Lucky for you, the JUICE team is here to help. Here are our tried and tested practices and techniques to stretch your Ringgit, and pave the path to smarter and more personalised money management techniques.

1. MAE: Your Financial BFF Beyond the Basics

Meet MAE, Maybank’s financial companion that does way more than just track your spending.

The app’s unique features, from spending categorisation to the Tabung function that helps you save up to your goal, are meticulously designed to align with the pulse of Malaysian lifestyles. For many, it’s not just an app, but a financial confidant of sorts.

Plus, with the added food delivery feature, users can order food, groceries, and settle their banking all in one app. Sama-Sama Lokal, a platform under the MAE app, also allows users to place their orders with local merchants to help support the local culinary scene – major plus if you’re a part of it and looking to expand your reach!

2. There Are Also Tons Of Other Apps That Show You Where Your Money Really Goes

Spendee and BigPay are among some of the most reliable apps that offer Malaysians a magnifying glass into their spending habits.

They simplify expense tracking, providing detailed insights to empower users in making informed financial decisions. With Spendee, users can easily track their expenses, categorise them, and create budgets to manage their finances effectively. The app’s visualisation features, such as graphs and charts, offer a clear understanding of spending patterns, contributing to enhanced financial clarity.

On the other hand, BigPay serves as a versatile mobile wallet, providing Malaysians with a convenient and efficient way to manage their money. As a prepaid card service, BigPay offers users the flexibility to make both domestic and international transactions, often with competitive exchange rates. It is particularly beneficial for those who travel frequently or engage in cross-border transactions, ensuring that financial activities are seamless and cost-effective.

Finding it difficult to pick between the two? Choose both! By combining the expense tracking prowess of Spendee with the mobile wallet and prepaid card features of BigPay, users have the tools they need to navigate their financial landscape with ease. Financial clarity is just a tap away, no matter what bank you opt for.

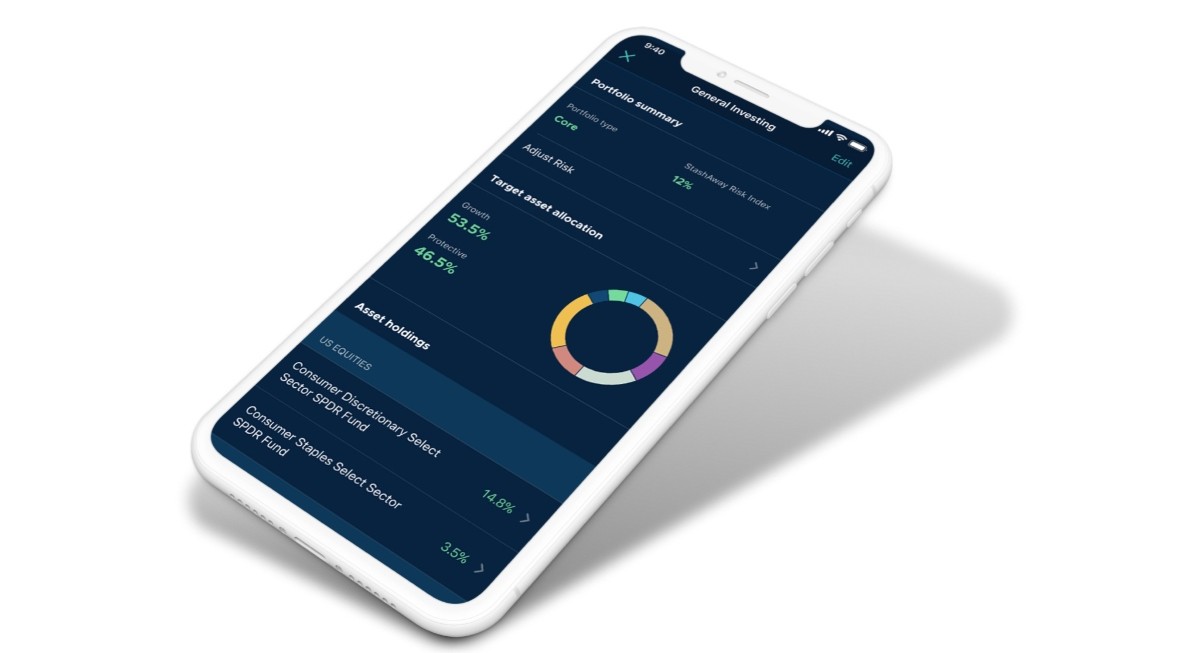

3. StashAway Will Elevate Your Savings Game

Enter StashAway, a game-changer for long-term savings in Malaysia. This trusted platform offers investment opportunities with returns that are said to outshine traditional fixed deposits, opening up a world of possibilities for Malaysians seeking wealth growth.

Leveraging robo-advisor technology, it tailors personalised investment portfolios based on users’ risk profiles and financial goals, offering a globally diversified range of assets. With a transparent fee structure, low minimum investment, and goal-based investing, StashAway provides Malaysians with a user-friendly avenue to achieve substantial returns that surpass traditional fixed deposits. The platform’s commitment to regular monitoring and automatic rebalancing ensures adaptability to market changes, making it a popular choice for those seeking wealth growth and financial empowerment.

4. Make The Most Of Your Credit Card

Find out the wonders of the credit cards you own, and you’ll be welcomed into a world where you are rewarded for simply spending, and weekends become a cashback haven. We suggest the Maybank Gold AMEX credit card, which not only boosts your wallet with enticing cashback benefits (5% cashback on weekend transactions, capped at RM50 per month) but also offers points that come with spending, bringing Malaysians closer to exclusive rewards and freebies.

Specifically designed to enhance weekend spending, this card offers generous cashback incentives on weekend transactions, making it a compelling choice for those seeking both financial perks and exciting extras! Although it’s not as widely accepted as Visa or MasterCard, its rewards definitely make the search worth it.

5. NEVER Misplace Your Cards… Or At Least, Know What To Do If It Happens

This one is a given, but losing things is almost inevitable. What’s important is recognising the damage and knowing how to tackle it.

Some losses come with more than just the inconvenience of searching through forgotten pockets. As someone who lost her debit card thrice this year, here’s a reality check: It’s not always a trivial matter. It’s a potential security nightmare.

It might not be hiding in your favourite pair of forgotten trousers. Instead, it could be lying on the road or the floor of your go-to convenience store. And yes, there’s a good chance it might fall into the wrong hands.

Your Identity Card (IC) isn’t just a piece of plastic with your photo; it’s a gateway to a world of possibilities for those who find it. People can misuse your IC for various activities, potentially leading to a host of troubles for you.

And if you think losing your SIM card is a minor hiccup, think again. A lost SIM card can be a tool for unauthorised calls and activities that’ll be billed to your account. It’s not just about misplacing a small piece of plastic; it’s about safeguarding your financial well-being. Hit that killswitch (I use MAE and the button is available on the Mobile App with just one click), and make those necessary calls ASAP.

Not to mention, there are fees to replace these essential documents, adding insult to injury. So, in the immortal words of advice: While you’re busy tracking your digital spending, don’t take your eyes off your tangible documents. Just don’t.

6. Trust Issues? Don’t Be Ashamed To Use Paper

Okay, okay. FinTech is great, but it does come with its own set of risks, and may not be as detailed as one may desire when it comes to breaking down finances.

As a wise man (Samuel L. Jackson) once said, paper is great because no one can hack into that sh*t. Embrace the simplicity of a cute notebook and create a personalised spending diary that ensures your financial details remain offline and secure. While the consistent manual entry might feel a bit icky, this method allows you to delve into the specifics of your expenses, eliminating the need to puzzle over vague entries like ‘Others’ and providing a tangible, trustworthy alternative to digital tracking.

Also, if your parents are anything like mine and cannot (refuse to) get the hang of digital financing, this old school option is the next best thing! Take it from the dude who comes by my area in his lorry selling all types of bread and snacks every evening, taking endless notes in his Buku Tiga Lima as he goes.

7. Wise by Visa and BigPay for Travel

Wise by Visa and BigPay offer excellent solutions for travellers. Both provide better exchange rates when exchanging cash, ensuring a cost-effective option for international travellers. Not to mention – easier, hassle-free transactions across the globe.

No need to worry about losing your Wise card; it’s digital and accessible on your phone or laptop. Ideal for international use, the Wise card charges a low fee on withdrawals abroad after the first RM1,000. Regarded as the most international debit card globally, it ensures transparent transactions with the real exchange rate, free from markups and hidden fees.

Meanwhile, BigPay, previously a MasterCard, has transitioned into a Visa card – retaining its convenience for travel and everyday transactions. Your BigPay card works globally, online or offline. Easily make local or international bank transfers from your phone, simplifying money transfers and bill splitting. Plus, you earn airasia points on every payment, adding a rewarding touch to your transactions. Frequent flyers rejoice!

There you have it! Whether you opt for cutting-edge apps, trusty paper diaries, or travel-friendly cards, the goal remains the same: Smarter and more personalised money management for a financially fit future.

You’re all set to conquer your financial goals in 2024! Oh, and if you wanna look the part (a la Sofia Richie), you may wanna check this out….

Got more tips for us? Let us know in the comments!

Cover image via iStock

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM