Coffee, Clothes & Concert Tickets Are The Essentials Of Gen Z, But We’re Forgetting One Thing…

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

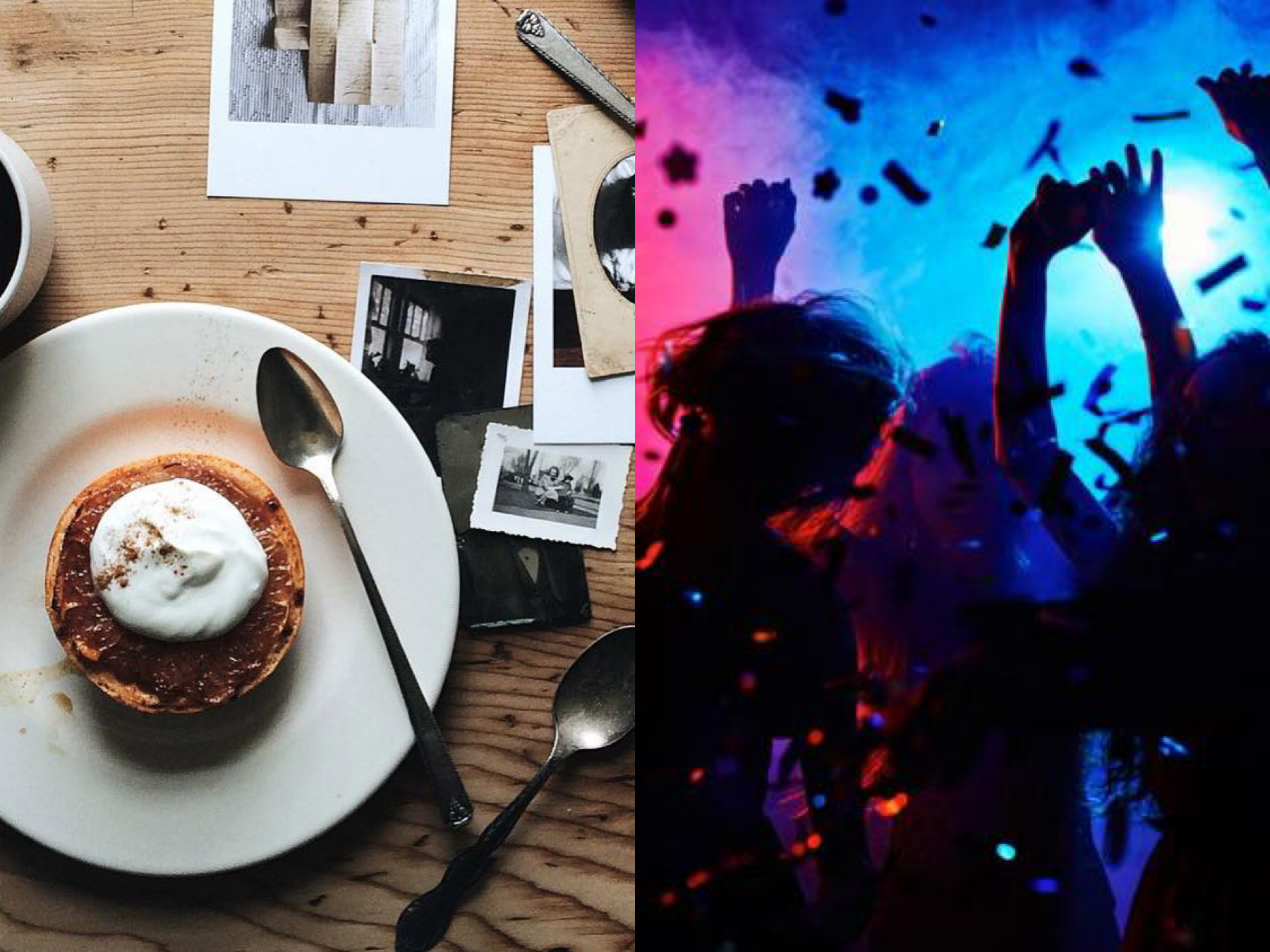

Whether its a cup of coffee, or your daily dose of music, there’s just some things we can’t live without. The word “essential” became a buzzword during peak Covid season, but let’s dial it back to what it really means to have all your essentials.

As a Gen Z baddie myself, I’d say most of our essentials are coffee, food, and the pair of shoes we’ve been eyeing for months. But we’re forgetting something that’s just as important – insurance.

I know what you’re thinking, “We’re getting to that age where most of our friends would ask to meet up just to sell insurance.” But besties, they’ve got a point!

Insurance isn’t just something that has to do with adulting or another form we have to learn to fill up. It’s a way to manage your risk and ensure that you have protection in every aspect of your lives. Would you want to be paying for full medical costs after getting into an unfortunate accident? I didn’t think so.

Introducing PRUFirst, where their Basic plan is a comprehensive 5 in 1 plan that covers Medical, Accident, Life/Total Permanent Disability (TPD) and Payor benefits! It provides you the convenience and ease to get all the essential coverage you need in one plan.

Never heard of these terms before? Well, you’re in luck. Let’s dive in:

PRUFirst’s medical coverage basically means that you will get reimbursed for the expenses incurred if you were hospitalised or receive out-patient treatment. Yes, that means you won’t have to break the bank in case you break a bone.

Imagine you’re out skating with your buddies, and you fall and get an injury and eventually have to be hospitalised. You wouldn’t want to sell your skateboard just to afford your hospital bills!

As we all know, life doesn’t always go as planned. PRUFirst also provides dual accident coverage with disability/death benefits from RM100,000, reimbursement of medical costs from RM5,000 and more, for any mishaps that are bound to happen. Quick reminder: drive safe out there! Except for the passenger princesses, just buckle up and look cute.

But we wouldn’t even be talking about this if not for the most essential thing – life insurance! Make sure your loved ones are covered too in unexpected events with Life/TPD coverage from RM100,000.

In the unfortunate event of a TPD or critical illness diagnosis of a parent or guardian, the payor benefit will cover the premiums to ensure continuous protection at no monetary cost to us Gen Z’s. This takes off some of the weight from an ill-fated circumstance so we wouldn’t have to worry about it.

Sound good to you? I haven’t even gotten to the best part yet. PRUFirst designed the policy to be incredibly flexible to fit all of our lifestyles, so you could pick and choose which add-ons you might want to include in your package.

Think of it like a customisable in-game character, you could easily mix and match the items in your inventory to best suit your game play.

Maximise your PRUFirst plan with medical booster, and Total Multi Crisis Care (TMCC) as an income replacement. With these two added plans, it stands at just RM204 per month.

I’d personally suggest to opt for the medical booster to include into your basic medical coverage as an upgrade. Get this: imagine auto-increasing coverage that ages with you. That means it only gets better as you get older! That’s way too good to pass up.

It starts at RM1.38 million and that amount only gets bigger the older you get. That way, you stretch the currency to the max, even when inflation or recession hits. And we all know it’s been hitting… By the way, this also includes unlimited hospitalisation stays!

Speaking of upgrades, critical illnesses can strike at any time and life-changing events can’t be predicted (the pandemic taught us that).

So protect your lifestyle with another added booster of PRUFirst’s critical illness insurance policy that provides financial aid in the form of a lump sum payment made directly to you through their Total Multi Crisis Care (TMCC) benefits.

After all, we wouldn’t want to suddenly go broke from an unexpected hospital bill. How else would we be able to afford all those iced lattes? With the medical booster and their critical illness booster, you’re all set to take on the world!

PRUFirst is catered towards Zoomers to ensure that we are able to enjoy our lifestyles without forgetting the truly essential parts of transforming the narrative of “life protection” to “lifestyle protection.”

Insurance is summed up as that one Harry Nilsson song that all our parents know – I can’t live, if living is without you. Getting a comprehensive insurance plan is just as essential as your life’s essentials, for you to live confidently.

View this post on Instagram

So what are you waiting for? Sign up now by clicking here. Get your essentials checked, besties!

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM