What’s All The Hype Around Apple Pay? Here’s Why You Shouldn’t Sleep On The Best Payment Option

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Two days ago, another payment option has been introduced in Malaysia and while many of us may already understand the hype around it, how does it actually work?

The concept allows users to make payments through their phones. Before you start saying that it’s nothing special, that we already have QR codes to scan, or multiple other apps that allow transactions device-to-device, I get it.

But imagine not having to leave the house with your wallet, and no more waiting time for your app to load with the excruciating pressure of the person in line behind you, also awaiting their log in details to be verified.

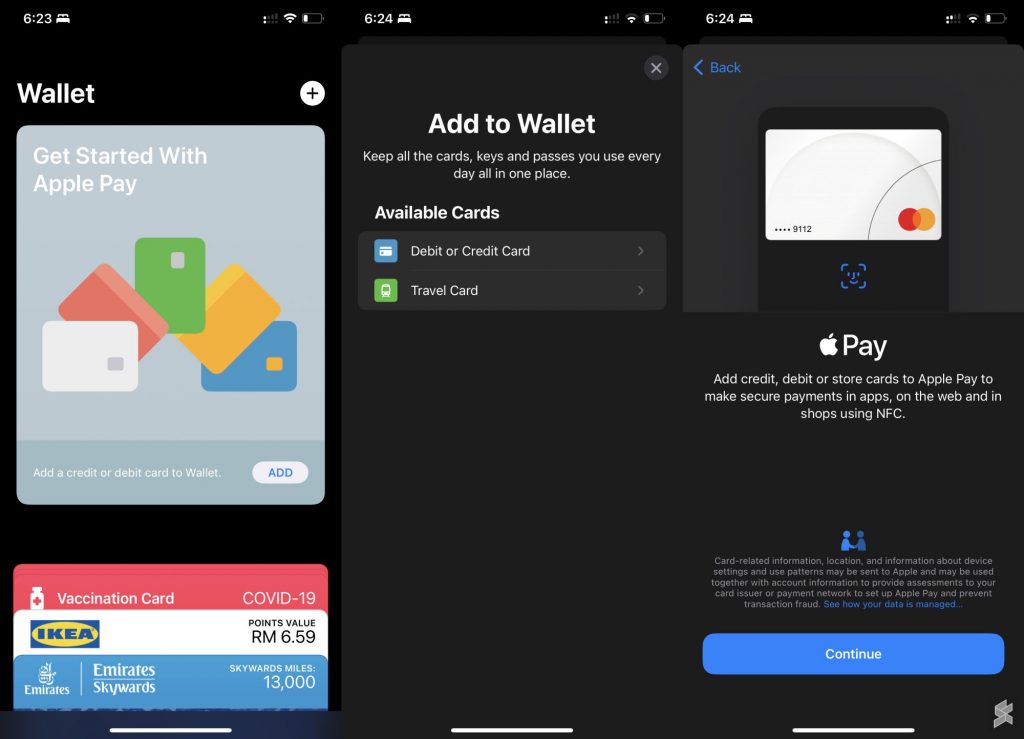

Apple users, are you intrigued yet? Here’s how to set it up:

- Open your Wallet app

- Tap on the + icon on the top right corner

- Select your card option (credit or debit)

- Scan your card with all the details in place

- Verify your card with an automated OTP code

…and that’s it!

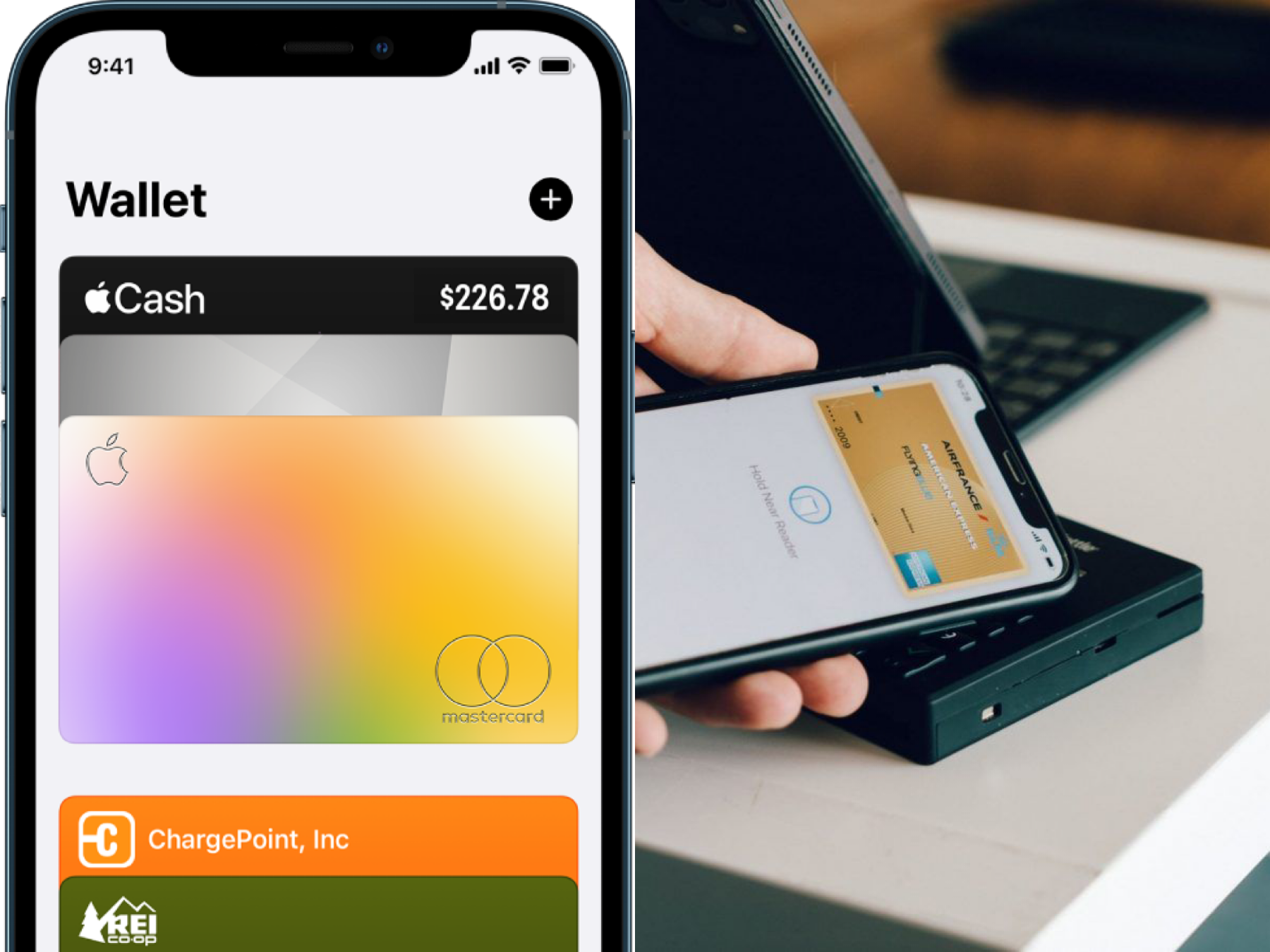

Once your Apple pay is set up, all you have to do is double click your lock button, scan your face ID, and hold it near the card reader.

Sounds like magic, but it’s really just technology that took way too long to arrive in Malaysia.

Every model above the iPhone 6 has a built-in NFC (near-field communication) chip, which allows for interactions and exchange of information when it is held near a reader, or in other words, that thing they tell you to scan your card on when you make a payment.

And if you’re an Apple Watch owner, you can set it up on there too! Imagine making payments with a simple flick of the wrist, literally.

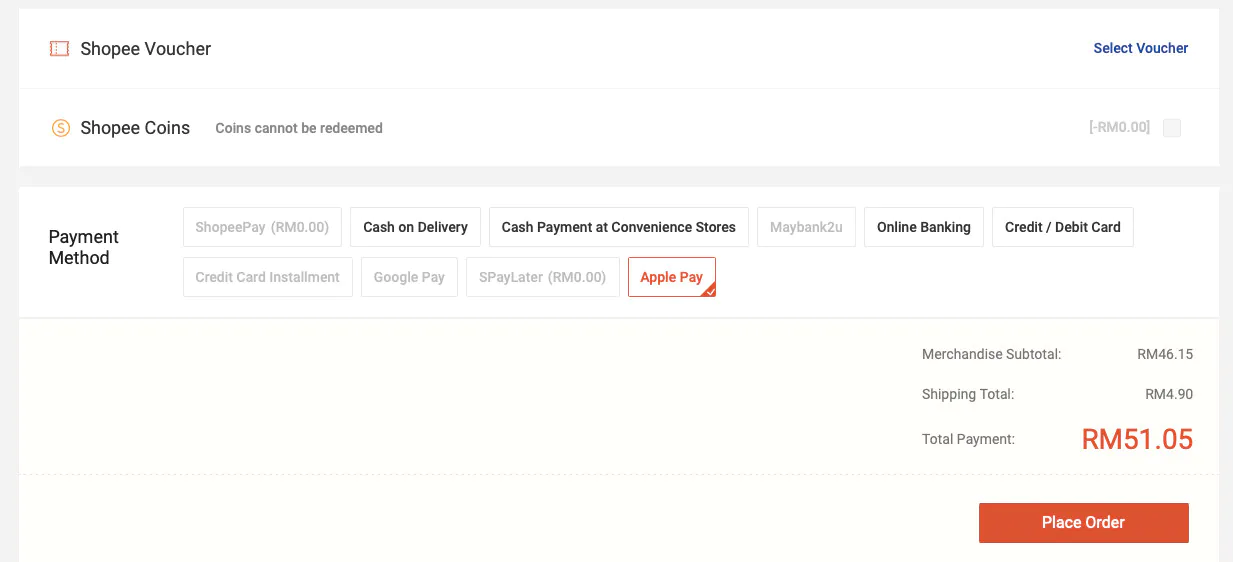

As for online transactions, it works the exact same way. Shopee actually teased us with Apple pay as an option when checking out, days before they announced the release. Simply select the option and go through the same motion of double tapping, scanning, and verifying.

You might think that there would be security issues when it comes to this life-changing payment option. But fret not, if your phone ever gets lost or stolen, nobody else would be able to access your private information. You’d still need your face ID to log in to the Wallet app and/or make transactions.

For Android users, I’m sure you’re already familiar with Samsung pay. It’s essentially the same exact concept that arrived in 2017, except it still requires your pin for transactions above a certain amount. So if you’re hesitant towards change, get with the times!

In short, Apple pay isn’t just another payment option. It’s the payment option.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM