GST vs. SST: A Snapshot at How We Are Going To Be Taxed

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

So, we’ve finally heard the news that 6% GST is finally being removed (yay!) but we’ve also heard that the government is reimplementing the SST; the Sales and Services Tax. If you’re a little like me and confused of what the Sales Tax is and how it is anything different to the GST, keep reading.

Pakatan Harapan promised in their manifest that they would abolish the 6% Goods and Services Tax (GST) within the first 100 days of coming into power. The ministry of finance announced that it will be zero-rated by June 1st. In turn, the government would place SST in its place to offset and take into account of the shortfall of revenue from the removal of the GST.

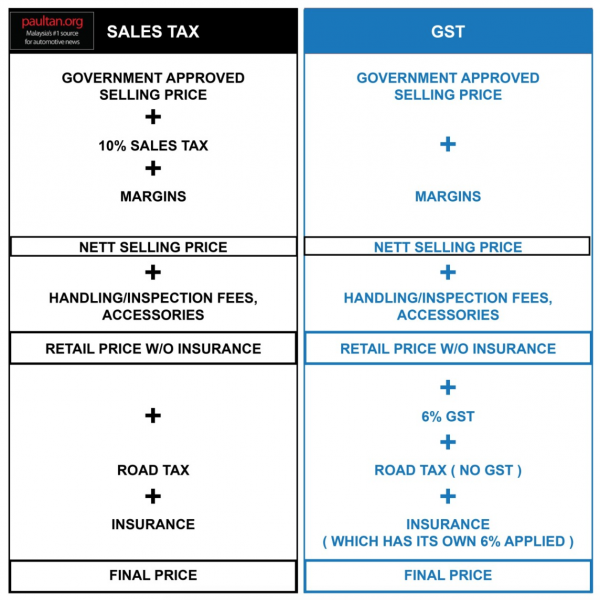

An illustration on how SST was previously charged for the purchase of cars. (Source: paultan.org)

As you know the 6% GST was introduced in Malaysia on 1st April 2015, which replaced the SST. In turn, the laws that governed the SST, Sales Tax Act 1972 and Service Act 1975, were repealed.

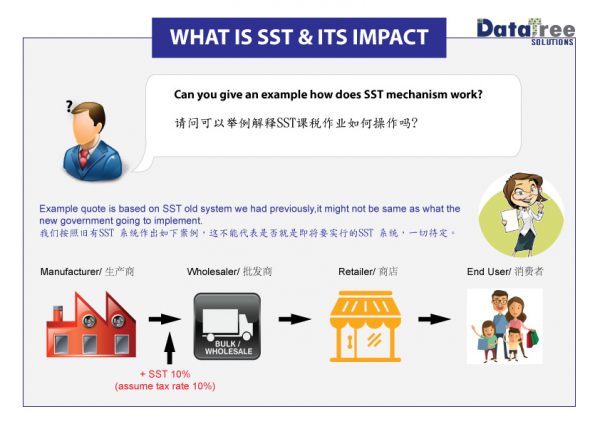

The SST is a single stage of consumption tax which businesses cannot recover the tax paid on their purchases. The biggest difference between the Sales and Service Tax (SST) and the Goods and Services Tax (GST) is that SST is more of a direct taxation. In turn it is now treated as another added cost to business.

The Sales Tax is imposed only to the manufacturer or consumer level and the Service Tax is imposed to consumers who are using tax services. SST rates are not as transparent as the 6% rate of GST, they vary from 5-10% to specific rates.

Raja Kumaran, the executive director and head of indirect tax of PricewaterhouseCoopers Malaysia has noted that “GST as you know covers everyone, retailers and traders. On the other hand, sales tax only covers manufacturers while services tax covers certain prescribed services such as professional services, so there must be a thought process on the transition to SST.”

There are still ongoing debates amongst the public and economists on the effectiveness of the SST in replacement to the seemingly more transparent GST. There still hasn’t been an official announcement on the specific rate for the SST, so we shall wait with baited breath.

What do you think of SST? Let us know in the comments!

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM