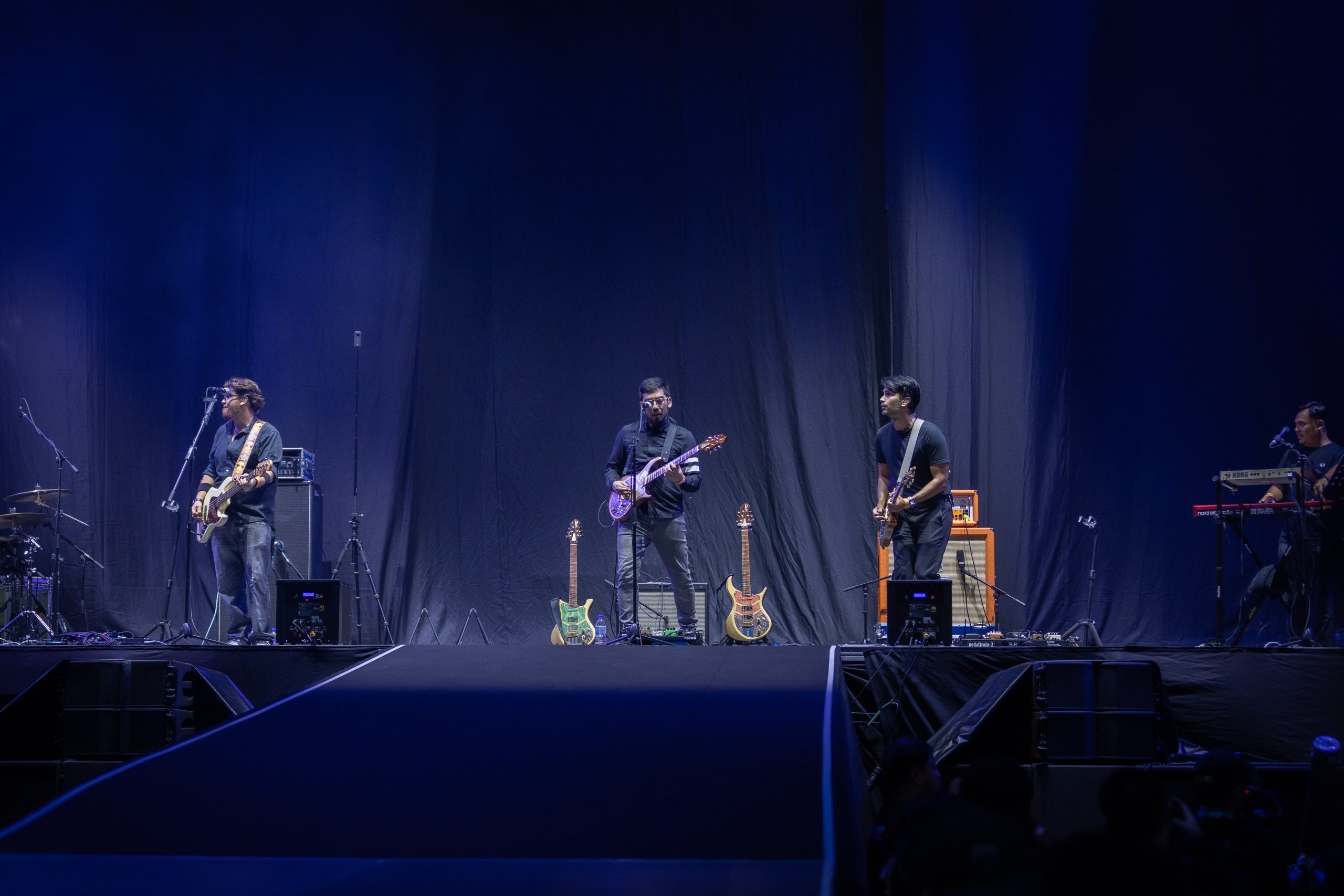

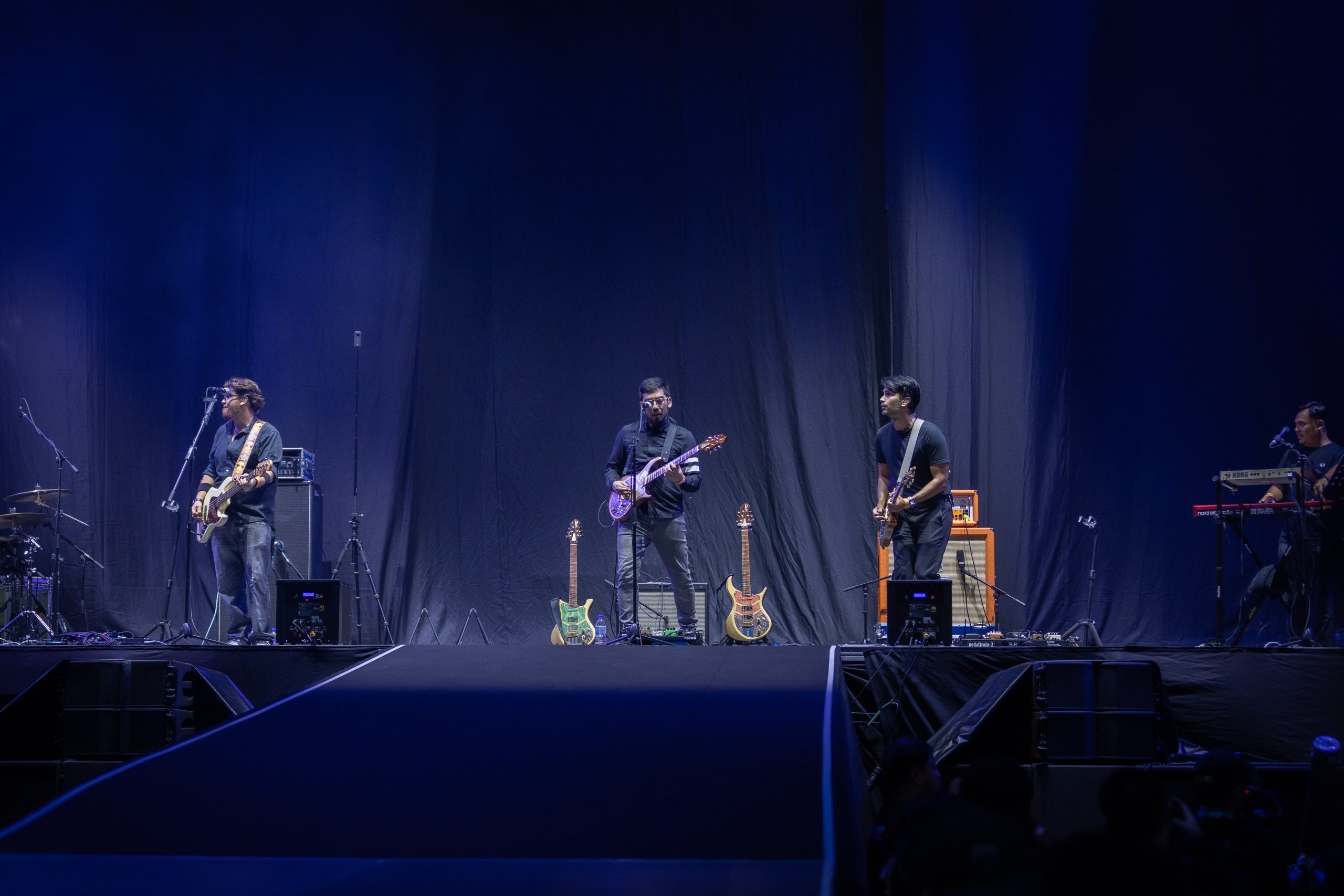

DBKL’s 25% Entertainment Tax on Live Performances May Do More Harm Than Good

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

If you’ve noticed that the likes of Singapore and Bangkok have been receiving more prominent international artists performing concerts, one reason they have not stopped by Malaysia might be the 25% Entertainment Tax on Live Performances imposed by the Dewan Bandaraya Kuala Lumpur (DBKL) in Wilayah Persekutuan.

In a letter addressed to government authorities, ALIFE emphasised the need for immediate action to prevent catastrophic economic consequences and to ensure the continued competitiveness of the live performance industry in the region.

Formed in 2016, the Arts, Live Festivals and Events Association (ALIFE) is a non-profit organisation that aims to fight for and protect the rights of everyone involved in the entertainment industry.

The 25% Entertainment Tax rate, established in 2001 and last updated in 2006, is no longer aligned with the current socio-economic landscape. The live performance industry has evolved significantly since then, with changes in ticketing systems being just one example.

In the past decade, the live performance industry in Wilayah Persekutuan was exempted from entertainment tax due to various factors, including Visit Malaysia Year in 2014, the implementation of the Goods and Services Tax (GST) from 2015 to 2018, and the impact of the COVID-19 pandemic

The sudden imposition of high Entertainment Tax rates could have severe repercussions, potentially leading to the industry’s collapse, especially when many producers are still recovering from nearly three years of inoperability during the pandemic.

A modern and consistent approach to taxation is essential to enable the industry to compete with its regional counterparts. Any rate higher than these countries’ tax structures would diminish Wilayah Persekutuan’s competitiveness.

ALIFE has actively engaged with government ministries, including the Ministry of Finance, Ministry of Tourism, Arts and Culture, and the Ministry of Communications and Digital Economy, to address this critical issue.

While there is unanimous agreement that a high entertainment tax could have detrimental effects on both the industry and the nation, a conclusive decision has yet to be reached. To avert an impending crisis and safeguard the live performance industry, ALIFE is urging for a comprehensive reassessment of the Entertainment Tax structure in Wilayah Persekutuan.

Failing to act swiftly could potentially lead to event cancellations, substantial income loss for artists, producers, venues, and workers, and damage to the nation’s reputation as a welcoming and business-friendly country, the organisation said.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM