Bills, Bills, Bills: Here Are 8 Potential Price Hikes Coming Up In July

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Thirsty for JUICE content? Quench your cravings on our Instagram, TikTok and WhatsApp

Amidst daily developments across the globe, including agricultural changes, tech advancements, nation-to-nation disputes and the eternal strain the Covid-19 pandemic has left behind, it is inevitable for these shifts to begin impacting our daily lives.

Unfortunately, these issues seem to have a chokehold on even the most basic human necessities.

Here’s a round-up on 8 potential price hikes coming up in July that have been announced so far:

1. New Proton vehicles

Proton Holdings Bhd has reportedly decided not to increase the prices of its automobiles, with the exception of the new X70 and the newly introduced Saga, due to a sudden increase in production costs.

However, as the prices of raw materials keeps rising and the sales tax exempt status expires, a price hike for new Proton cars and other auto manufacturers appears inevitable.

Nonetheless, Proton deputy chief executive officer Roslan Abdullah stated that the domestic automaker was attempting to extract as much of the soaring production costs as possible without passing them on to buyers.

“As of today, we have no plans to raise the costs of our vehicles, excluding the new X70 and the recently introduced Saga,” Roslan told reporters following the virtual reveal of the 2022 Proton X70 today, as per NST.

Roslan also mentioned that the change was owed to rising automotive parts and component costs over the past 2 years due to the global pandemic.

2. Electricity

According to a report by the Vibes, Malaysian consumers can expect a surtax on their power bills next month as a result of the persistent dispute between Russia and Ukraine, which began in February this year.

Tenaga Nasional Berhad (TNB) is having trouble maintaining current costs due to a dramatic increase in coal prices, which have risen 4 times since the beginning of the Russia-Ukraine war.

The report states that coal accounts for almost half of Malaysia’s required power supply.

The Imbalance Cost Pass-Through (ICPT) formula, which specifies whether the expense of fuel is transferred into the final electricity bill for customers, is assessed every 6 months.

The next ICPT evaluation is due next month.

In a subsequent update, the publication stated that approximately five million Malaysian homes are likely to be exempt from the forthcoming surcharge, citing sources who stated that consumers billed less than RM77 per month for electricity, or with a monthly consumption rate of 300 kWh or less, may be exempt from the fee.

Update: PM Ismail Sabri has announced that there will be no increase in tariffs for electricity and water in Peninsular Malaysia.

3. Withdrawals made via MyDebit Cashout

Multiple local banks including Alliance, HSBC, Bank Islam, OCBC, Standard Chartered, CIMB Bank and CIMB Islamic Bank Bhd have released statements notifying customers that MyDebit Cash Out fees of RM0.50 per transaction will be placed at any MyDebit-preferring merchants/retailers beginning July 1, 2022.

All cardholders will be subject to the new MyDebit Cash Out Fee.

The bank also mentioned that the maximum withdrawal limit for MyDebit Cash Out is currently RM500.

Previously, the function was made available free of charge.

PayNet, the provider of the MyDebit Cash Out service to a number of Malaysian banks, has yet to openly declare or reveal any details regarding the fee.

4. No more SST exemption for new vehicles

The SST exemption was first announced on June 5, 2020, as an aspect of the Penjana stimulus program designed to minimise the effects of the first MCO, which took effect in March of the same year.

The exemption was primarily set to expire on December 31 2020, but it was lengthened at the last minute to June 30, 2021, and then again to December 31, 2021.

The current extension was declared during the tabling of Budget 2022.

However, the government has also taken into account the automotive industry’s hefty stock concerns and has permitted the SST exemption to pertain to any car booking made before the dateline, as long as it is registered before 31 March 2023.

According to MOF, there are presently 264,000 bookings left unfulfilled.

The matter has formed confusion amongst netizens who were curious as to the details of the exemption, including guidelines and eligibility for pre-launch reservations as well as other circumstances following their unique situations.

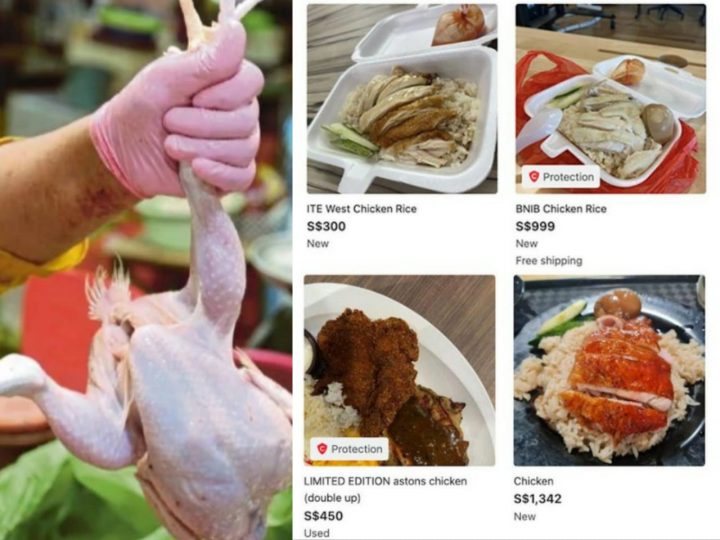

5. Chicken and eggs

When the ceiling price is lifted on June 30, the cost of chicken is estimated to range between RM10 and RM12 per kg.

Chicken is currently valued at RM8.90 per kg. The chicken and chicken egg price ceilings, which took effect on February 5, have been extended until June 30.

According to the Minister of Domestic Trade and Consumer Affairs, livestock farmer groups have informed the ministry that, while chicken prices will increase, they will not rise too dramatically.

This is in line with the recent domestic chicken shortage which has pecked at the local poultry industry and chicken enthusiasts for months. Export restrictions have since been placed to curb the issue and ensure that supply meets demand in Malaysia.

Update: In a statement today, PM Ismail Sabri claimed that a new ceiling price will be disclosed “in the near future” by Agriculture and Food Industries Minister Datuk Seri Ronald Kiandee.

6. Palm cooking oil

The government will discontinue all subsidies for bottled cooking palm oil products on July 1, with the current market price of RM29.70 for a 5kg bottle likely to increase.

The subsidy, which was initiated last year and was originally intended to last only 3 months, will be phased out for bottled products sold in 2kg, 3kg, and 5kg bottles.

While prices for those are expected to rise by a few ringgit, the withdrawal of subsidies does not include the 1kg polybags of oil generally marketed at RM2.50, according to the Vibes.

As per Datuk Seri Alexander Nanta Linggi, Minister of Domestic Trade and Consumer Affairs, the peak selling cost for palm cooking oil in 5kg bottles is RM29.70- 1kg bottles are sold at RM6.70, 2kg at RM12.70, 3kg at RM13.70 and 4kg at RM18.70.

When asked to justify the government’s rationale behind the subsidy expulsion, he stated that the subsidy was intended to be transitory when it was introduced last August.

“So, the government now feels the time has finally come to repeal the financial assistance so that it can concentrate on attempts to assist others in need through focused aid,” he said, adding that the oil subsidy had cost the ministry around RM20 million per month.

Additionally, Prime Minister Datuk Seri Ismail Sabri Yaakob previously stated that the subsidy for cooking oil, with an allocation of RM4 billion for 2022, may increase if the cost of palm oil goes up.

7. Carlsberg beer, stout and cider

Yup, you read that right.

Carlsberg Brewery Malaysia Bhd has released a statement explaining that it will raise the prices of some of its products in accordance with rising input costs.

The company mentioned that despite its cost-cutting efforts, they had to “adjust” product prices due to increased expenses exacerbated by the Russia-Ukraine conflict.

“We would like to inform you that, due to the massive increase in input costs, which has been aggravated by the Russia-Ukraine war.

“That’s why we have decided to introduce price adjustments for a selection of our products,” said the company, according to the Edge.

The new rates for the group’s beer, stout, and cider will go into effect on July 1, according to Carlsberg, who added that the retail selling price remains up to the discretion of the retail chains.

Meanwhile, Heineken Malaysia Bhd has remained tight-lipped about any price increases for its goods, instead stating that it will keep monitoring input costs to ensure that it stays competitive.

8. Farm Fresh’s RTD products

Farm Fresh Bhd also plans to raise prices of its chilled ready-to-drink (RTD) goods by an estimate of 5% in mid-July this year.

The dairy product specialist stated in a lodgement on Tuesday (May 24) regarding its financial results for the fourth quarter ending on March 31, 2022 that the planned action was prompted by the tough environment it functions in, which is characterised by rising inflation from increased input prices and economic ambiguity induced by Russia’s military takeover of Ukraine.

“Considering the long-term nature of the group’s headwinds and to offset greater input prices, the team is raising costs for its chilled RTD products in Malaysia by an average of 5% effective mid-July 2022 and increasing costs for its chilled RTD products in Singapore by an estimate of 8% effective Aug 1, 2022,” it said.

In September and December of last year, the group placed a 5% price increase on chilled RTD dairy products and ultra-high thermal processing RTD products, respectively.

Prior to last year’s price hike, the company had not raised rates for four years.

This is so sad, Alexa play ‘Bills, Bills, Bills’ by Destiny’s Child.

Get Audio+

Get Audio+ Hot FM

Hot FM Kool 101

Kool 101 Eight FM

Eight FM Fly FM

Fly FM Molek FM

Molek FM